Source: China Petroleum News Center

“In 2024, China’s titanium industry maintained overall stable development. Titanium product output continued to grow, the industry became increasingly concentrated, titanium consumption showed segmentation across sectors, and import–export trade remained on an upward trend,” said Ge Honglin, Party Secretary and President of the China Nonferrous Metals Industry Association, at the 2025 Annual Conference of the Titanium, Zirconium, Hafnium & Vanadium Branch and the Titanium Valley Industry Development Forum.

According to statistics, China’s titanium industry showed steady progress in production from January to February 2025. Titanium concentrate output reached 1.887 million tons, imports totaled 879,000 tons, and consumption stood at 2.165 million tons, up by 3.6%, 26.2%, and 4.5% year-on-year, respectively. Sponge titanium output was 41,000 tons, exports 1,000 tons, and consumption 40,900 tons—rising by 12.8%, 28.6%, and 11.7%, respectively.

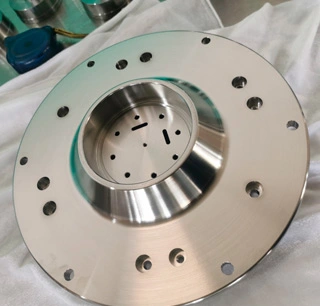

Titanium is a critical material for aerospace, marine engineering, medical, and 3C industries (computers, communications, and consumer electronics).

In terms of industrial scale, China’s sponge titanium output in 2024 reached 256,000 tons, a 17.6% year-on-year increase, with near 100% self-sufficiency. Titanium material output reached about 170,000 tons, up 7%, accounting for 65% of global production—making China the world’s largest producer and consumer of titanium materials.

In product upgrading, titanium consumption in 2024 was about 150,000 tons, still dominated by the chemical and aerospace sectors, while usage in the 3C sector continued to grow. China needs to accelerate the development of new products to meet the urgent demands of high-performance titanium alloys in advanced manufacturing.

“The titanium industry has demonstrated strong resilience and vast potential in resource security, technological innovation, and market expansion, and has formed a complete industrial chain. While technological capabilities and production capacity continue to grow, and application fields are expanding, challenges remain,” said Duan Debing, Executive Deputy Secretary of the Party Committee and Vice President & Secretary-General of the China Nonferrous Metals Industry Association.

Technological Upgrades

In terms of metallurgical processes, it is necessary to upgrade melting technologies to improve the quality and performance of titanium alloys, thus supplying high-end application sectors with superior materials.

For processing technologies, the adoption of advanced manufacturing techniques such as additive manufacturing, superplastic forming, and precision forging should be accelerated to realize near-net shaping of complex structural components.

Industry Performance

Integrated enterprises with full industry chains and those focused on niche high-end sectors continue to perform well, leveraging their strengths. However, semi-process enterprises and small to medium-sized businesses face more difficulties and less stable profitability.

Additionally, with significant capacity expansions in sponge titanium and processed titanium materials, supply–demand imbalance has led to intensified “involution-style” (internally competitive) pricing pressures and further price declines for finished products.

To reduce redundant construction, low-efficiency expansion, and price competition, the titanium industry needs deeper vertical integration and better resource allocation to improve industry efficiency. Ge Honglin emphasized the importance of accelerating the integration and optimization of innovation resources, strengthening collaboration among government, industry, academia, research institutions, and end users. While leveraging favorable policies and reinforcing basic research, efforts should also be made to strengthen applied technology R&D, promote the transformation of innovation outcomes, and comprehensively upgrade technologies, processes, and equipment across the industrial chain.

English

English  日本語

日本語  한국어

한국어  Deutsch

Deutsch  русский

русский  العربية

العربية